Friday, December 29, 2017

JCT distribution tables

Courtesy Greg Mankiw, the Joint Committee on Taxation distributional analysis of the new tax law.

Bottom line: No change. Income categories are paying almost exactly the same share of federal taxes as before. Millionaires actually pay a tiny bit larger share in the new bill.

Given the distributional hue and cry, frankly, it is a surprise to me just how tiny -- far below measurement errors -- the changes are.

One can argue whether this is the "right" measure of progressivity or redistribution, whether a tax cut should include a change in which income categories pay what share. But it summarizes the facts, which are stubborn things. Shares of federal taxes paid by income groups do not change. Millionaires get bigger dollar tax cuts exactly to the extent that they pay higher taxes. Period.

Note to those outside the beltway: The Joint Committee on Taxation is the committee set up by Congress to evaluate tax policy. Most criticism I've seen of its calculations lately come from the right.

Bottom line: No change. Income categories are paying almost exactly the same share of federal taxes as before. Millionaires actually pay a tiny bit larger share in the new bill.

Given the distributional hue and cry, frankly, it is a surprise to me just how tiny -- far below measurement errors -- the changes are.

One can argue whether this is the "right" measure of progressivity or redistribution, whether a tax cut should include a change in which income categories pay what share. But it summarizes the facts, which are stubborn things. Shares of federal taxes paid by income groups do not change. Millionaires get bigger dollar tax cuts exactly to the extent that they pay higher taxes. Period.

Note to those outside the beltway: The Joint Committee on Taxation is the committee set up by Congress to evaluate tax policy. Most criticism I've seen of its calculations lately come from the right.

MR wisdom

Best sentence award:

France -- supposedly bureaucratic, dirigiste, labor-protected France -- builds subways and high speed trains for far less than we pay. Something about the US government makes us singularly inefficient in public expenditures. Don't expect the French health care model to cost the same here either.

A prime candidate, in my view, is the US habit of federal financing plus state and local decision making. Local politicians who are spending national taxpayer money have very little incentive to reduce costs.

"It will not escape notice that New York buys subway construction the way all of America buys health care."-Alex Tabarrok, Marginal Revolution, covering an excellent New York Times article on why subway construction in New York is so insanely expensive.

France -- supposedly bureaucratic, dirigiste, labor-protected France -- builds subways and high speed trains for far less than we pay. Something about the US government makes us singularly inefficient in public expenditures. Don't expect the French health care model to cost the same here either.

A prime candidate, in my view, is the US habit of federal financing plus state and local decision making. Local politicians who are spending national taxpayer money have very little incentive to reduce costs.

Thursday, December 28, 2017

Economists as Public Intellectuals

I ran across a video by my former Chicago Booth colleague Austan Goolsbee that prompts some reflection on the role of economists as public intellectuals. (In addition to my gentle scolding of Greg Mankiw in the last post.)

Austan:

Austan:

"Hi, I'm an actual economist (MIT PhD degree shown)

and I promise you

Donald Trump's tax plan is a scam. ...

This tax cut was designed to help Johnny Marshmallow (Billionaire, with monopoly man image) ...

President Trump believes that if you give more money to big corporations and billionaires that money will trickle down to you..."

Let us analyze the rhetoric of these amazing sentences carefully.

"I'm an actual economist (MIT PhD degree shown)"This is an argument by authority, by credentialism. He, Austan, has a PhD from a Big Name institution. What follows is therefore a result of that special knowledge, that special insight, that special training, that actual economists have. He doesn't have to offer logic or fact, which you won't understand, and you aren't allowed to argue back with logic or fact, unless perhaps you too have a Big Name PhD. What follows isn't just going to be Austan's personal opinions, it inherits the aura of the whole discipline. By implication, anyone who disagrees isn't an "actual economist."

"Donald Trump's tax plan is a scam"This are the most interesting 7 words.

Mankiw on endowment taxes

Greg Mankiw wrote a New York Times column December 24 criticizing the university endowment tax. I disagree, not so much with the wisdom of the tax, but with the wisdom of writing such an article.

The tax is small -- 1.4% of endowment income. So if $100 of endowment earns 10%, or $10 of income, the university pays 14 cents. Still, with $38 billion of endowment like Harvard's, or $22 billion like Stanford's that adds up to some real money.

Greg writes that it is "hard to justify this policy." Universities invest in "human capital, which means educating our labor force" and "the knowledge that flows from basic research." Mainly, though, Greg's against the tax because the few elite universities with more than $500,000 endowment per student, (unlike the community colleges and state schools that actually do train the labor force)

Lower rates, broaden base?

Does not every claimant on the public purse, anxious to preserve a tax deduction, claim that they provide a public good? The home builders, the mortgage bankers, and the real estate agents went apoplectic over limiting the deductibility of home mortgage interest. Because it was going to destroy the American Dream of Homeownership. Because building home equity is the tried and true, well, "engine of economic growth for the middle class!" Farmers demand agricultural subsidies to defend their storied way of life. Why, without the Family Farm, the fabric of American society is lost! The bankers demand immense leverage, deductibility of corporate interest, and a range of anti-competitive regulation because otherwise, who will lend to the middle class! The solar cell and electric car manufacturers want tax credits and subsidies because they're saving the planet. And on we go.

Conservative, "Republican," free-market principles used to be to advocate for lower marginal tax rates, and a broader base, in which everyone gives up their little deduction or subsidy. (I use "Republican" as Greg uses it, so don't go all nuts in the comments about Republican failings to live up to these ideals.)

How can we credibly proclaim that we, universities, provide the true public good and deserve subsidies, but the rest of you get lost? Do we not look just a little hypocritical if when a tax reform is announced, we jump in line with the rest of them to demand our pork back?

The tax is small -- 1.4% of endowment income. So if $100 of endowment earns 10%, or $10 of income, the university pays 14 cents. Still, with $38 billion of endowment like Harvard's, or $22 billion like Stanford's that adds up to some real money.

Greg writes that it is "hard to justify this policy." Universities invest in "human capital, which means educating our labor force" and "the knowledge that flows from basic research." Mainly, though, Greg's against the tax because the few elite universities with more than $500,000 endowment per student, (unlike the community colleges and state schools that actually do train the labor force)

"use their resources [to offer] need-blind, full-need admissions...."

"At Princeton [$24 billion] about 60 percent of undergraduates get financial aid. This aid covers the entire cost of tuition, room and board for students from families with income below $65,000 a year."In sum, Greg feels that universities provide a public good, of refraining from charging tuition for low-income students, so should retain this subsidy. And subsidy it is. While I think all capital taxes should be zero for everyone, given that everyone else pays capital taxes, the fact that universities can borrow at tax-free rates, accept tax-exempt gifts, put the money into endowments which are run like funds-of-funds, hiring high-priced managers to send money to high-priced managers of hedge funds, private equity, venture capital, and real estate, and pay no tax on dividends, interest, capital gains, ever, amounts to quite a subsidy relative to everyone else. And it comes out of taxes that universities do not pay, which means everyone else pays more.

Lower rates, broaden base?

Does not every claimant on the public purse, anxious to preserve a tax deduction, claim that they provide a public good? The home builders, the mortgage bankers, and the real estate agents went apoplectic over limiting the deductibility of home mortgage interest. Because it was going to destroy the American Dream of Homeownership. Because building home equity is the tried and true, well, "engine of economic growth for the middle class!" Farmers demand agricultural subsidies to defend their storied way of life. Why, without the Family Farm, the fabric of American society is lost! The bankers demand immense leverage, deductibility of corporate interest, and a range of anti-competitive regulation because otherwise, who will lend to the middle class! The solar cell and electric car manufacturers want tax credits and subsidies because they're saving the planet. And on we go.

Conservative, "Republican," free-market principles used to be to advocate for lower marginal tax rates, and a broader base, in which everyone gives up their little deduction or subsidy. (I use "Republican" as Greg uses it, so don't go all nuts in the comments about Republican failings to live up to these ideals.)

How can we credibly proclaim that we, universities, provide the true public good and deserve subsidies, but the rest of you get lost? Do we not look just a little hypocritical if when a tax reform is announced, we jump in line with the rest of them to demand our pork back?

Wednesday, December 27, 2017

Response to Williamson on taxes

Steve Williamson has an interesting new post on corporate taxes and investment, in which he claims that taxing corporate profits has no effect on investment.

What happens if the corporate tax rate goes up permanently, with the tax rate constant forever...? This has no effect on investment or on the firm's hiring decisions in any period. That is, if VB is before tax profits, then (1-t)VB = V, so maximizing VB is the same as maximizing V, and the tax rate is irrelevant, not only for investment decisions, but for the firm's hiring decision. In the aggregate, there is no effect on labor demand, and therefore no effect on wages.

Basically, investment is an intertemporal decision for the firm. But the corporate tax rate affects per-period after-tax profits in exactly the same way in every period, so there is no effect on the after tax rate of return on investment the firm is facing. Therefore, the firm won't invest more with a lower corporate tax rate ...Steve concludes

But, the tax bill is not about investment. The primary effect is redistribution. In the short run, the tax bill makes the rich richer and the poor poorer...You can see there is a problem. If Steve is right, then why not a 99.999% capital tax rate? Per Steve, it won't distort any decisions, neither investment nor hiring nor starting companies, it will give a revenue bonanza for the government and it will transfer income efficiently. Surely if 99.999% corporate taxes had no disincentive effects, governments would have noticed? Surely not every single Republican is, as Steve implicitly charges, either lying through his teeth or an economic ignoramus when they state the goal of the tax cut is to spur investment, and thereby productivity and wages?

The Fiscal Theory of Monetary Policy

"Stepping on a Rake: the Fiscal Theory of Monetary Policy" is new paper, just published in the European Economic Review. This link gets you free access, but just for the next few days. After that, I can only post the last manuscript. (I held off sending this hoping the EER would fix the figure placement in the html version, but that didn't happen.)

The paper is about how the fiscal theory of the price level can describe monetary policy. Even without monetary, pricing, or financial frictions, the central bank can fix interest rates. In the presence of long-term debt higher interest rates lead to lower inflation for a while. Interest rate targets, forward guidance, and quantitative easing all work by the same mechanism. The paper also derives Chris Sims' "stepping on a rake" paper which makes that point, and integrates fiscal theory with a detailed new Keynesian model in continuous time.

The paper is about how the fiscal theory of the price level can describe monetary policy. Even without monetary, pricing, or financial frictions, the central bank can fix interest rates. In the presence of long-term debt higher interest rates lead to lower inflation for a while. Interest rate targets, forward guidance, and quantitative easing all work by the same mechanism. The paper also derives Chris Sims' "stepping on a rake" paper which makes that point, and integrates fiscal theory with a detailed new Keynesian model in continuous time.

Tuesday, December 26, 2017

The Buyback Fallacy

Many commenters on the tax bill repeat the worry that companies will just use tax savings to pay dividends or buy back shares rather than make new investments.

Savannah Guthrie, interviewing Paul Ryan on the Today Show, thought she had a real gotcha with

Peggy Noonan, in an otherwise thoughtful column, echoed the same worry:

So, having established that this is a bipartisan worry, let's put the fallacy to bed. It is the fallacy of composition, that actions of one company mirror actions of the economy as a whole. It is the fallacy of "paper investments" vs. "real investments." That distinction can apply to a company, but not to the whole economy.

No, companies do not sit on vast swimming pools of gold coins, like Scrooge McDuck. One company's "cash" is a short term loan to another company, which the latter uses it to make real investments. Every asset (paper) is also a liability, backed by an investment. The charge fails to track the money. One of the few things economists know how to do is always to ask, "OK, and then what do they do with the money?" Money is a veil, and real decisions are (to first order) independent of financial decisions. (I use italics to suggest some ways to remember these basic economic ideas.)

Savannah Guthrie, interviewing Paul Ryan on the Today Show, thought she had a real gotcha with

"What they [CEOS] are planning to do is stock buybacks, to line the pockets of shareholders."(She then moved on to a question most guaranteed to produce retweets of partisan admirers, and least likely to produce an interesting answer,

"I'll ask you plainly, are you living in a fantasy world?"NBC then wonders that it is charged with partisan bias.)

Peggy Noonan, in an otherwise thoughtful column, echoed the same worry:

"Big corporations can take the gift of the tax cut ... and do superficial, pleasing public relations sort of things, while really focusing on buying back stock and upping shareholder profits."(Just how taking less of your money is a "gift" is a question for another day.)

So, having established that this is a bipartisan worry, let's put the fallacy to bed. It is the fallacy of composition, that actions of one company mirror actions of the economy as a whole. It is the fallacy of "paper investments" vs. "real investments." That distinction can apply to a company, but not to the whole economy.

|

| What corporate cash is not. |

Sunday, December 24, 2017

Friday, December 22, 2017

The High Cost of Good Intentions

The High Cost of Good Intentions is a superb new book by my Hoover colleague John Cogan. It is a political and budgetary history of U.S. Federal entitlement programs. It is full of lessons for just why the programs have expanded inexorably over time, and just how hard it will be for our political system to reform them.

If indeed the Congress will now turn to entitlement reform, as house speaker Paul Ryan has promised, this will be the book to have on your desk. (Ryan already blurbed it (back cover) as did Bill Bradley, Sam Nunn, George Shultz and Alan Greenspan.)

If you think entitlement programs, and the political hash that enacts them, are recent problems, or the fault of one political party, think again. John's main lesson is that the emergence of bloated entitlements is a hardy feature of our (and many other countries') democracies. He does this by just reading the history.

The habit of expanding entitlements started early. Chapter 2:

If indeed the Congress will now turn to entitlement reform, as house speaker Paul Ryan has promised, this will be the book to have on your desk. (Ryan already blurbed it (back cover) as did Bill Bradley, Sam Nunn, George Shultz and Alan Greenspan.)

If you think entitlement programs, and the political hash that enacts them, are recent problems, or the fault of one political party, think again. John's main lesson is that the emergence of bloated entitlements is a hardy feature of our (and many other countries') democracies. He does this by just reading the history.

The habit of expanding entitlements started early. Chapter 2:

Revolutionary War pensions were the nation's first entitlement program. ... between 1789 and 1793, the federal government agreed to pay annual pensions to Continental Army soldiers and seamen who became disabled as a result of wartime injuries or illness. [later, as an inducement to service]...

For forty years, Congress enlarged and expnaded these benefits until, by the 1830s, they covered virtually all Revolutionary War seamen and soldiers, including volunteers and members of the state militia and their widows, regardless of disability or income.That costs might balloon beyond forecasts was not a total surprise

Tuesday, December 19, 2017

Boot Camp

Hoover has just announced the 2018 Summer Boot Camp August 19-25 2018

The Hoover Institution’s Summer Policy Boot Camp (HISPBC) is an intensive, one week residential immersion program in the essentials of today’s national and international United States policy. The program is intended to instruct college students and recent graduates on the economic, political, and social aspects of United States public policy. The goal is to teach students how to think critically about public policy formulation and its results.

Using a highly interactive, tutorial-style model designed to foster fact-based critical thinking on the most important policy issues, students will have a unique chance to interact directly with the faculty of Stanford University’s Hoover Institution, comprised of world-renowned scholars in economics, government, political science, and related fields. Each half-day will be dedicated to one topic, chosen because of its immediate relevance to today’s and tomorrow’s challenges. Participants will collaborate through class discussions, study groups, and team projects that encourage diverse perspectives. Enrollment is limited, in order to facilitate maximum interaction with the faculty and other participants.This was a big success last year. I taught one section of the bootcamp, and I thought the students were a great cross section of really interesting smart people.

Oh, and it's free.

How to cut taxes and raise tax rates

How can you cut taxes but raise (distorting, marginal) rates at the same time? Add a deduction, but phase it out with income. Then people below the income limits pay less taxes. But as the income limit phases in, the marginal tax rate is higher than the previous rate. The new (and old) tax code is full of this perverse result.

For example, suppose you start with a tax code where everyone pays 50% of income. Then, add a deduction, credit, or exemption so people who earn, say, less than $100,000 of income pay no taxes. But phase it out over the next $100,000. Thus, people who earn $200,000 pay the original 50%, or they pay $100,000 of taxes. People who earn $100,000 pay no taxes. So, we have engineered a 100% marginal tax rate for people between $100,000 and $200,000 of income -- each dollar is completely taxed away!

In my example, we gain a 0% (down from 50%) marginal tax rate for people below $100,000 of income. But if the $100,000 is a fixed deduction or credit that does not scale with income, even that benefit is lost.

"Tax cuts" are not necessarily good for growth! It is possible to cut taxes and raise marginal rates, reducing growth.

This came to mind while reading the interesting "Games They Will Play"

I would love to see a true marginal analysis of the tax proposal. What are its actual incentives and disincentives, when you put it all together, not the constant who-gets-what commentary.

"Games They Will Play" is good reading if you have half a mind to pick up your pitchfork and join the other peasants in rebellion. It's phrased as problems with the new tax code, but it gives you a great condensed sense of just how rotten the old tax code is.

For example, suppose you start with a tax code where everyone pays 50% of income. Then, add a deduction, credit, or exemption so people who earn, say, less than $100,000 of income pay no taxes. But phase it out over the next $100,000. Thus, people who earn $200,000 pay the original 50%, or they pay $100,000 of taxes. People who earn $100,000 pay no taxes. So, we have engineered a 100% marginal tax rate for people between $100,000 and $200,000 of income -- each dollar is completely taxed away!

In my example, we gain a 0% (down from 50%) marginal tax rate for people below $100,000 of income. But if the $100,000 is a fixed deduction or credit that does not scale with income, even that benefit is lost.

"Tax cuts" are not necessarily good for growth! It is possible to cut taxes and raise marginal rates, reducing growth.

This came to mind while reading the interesting "Games They Will Play"

Individuals who provide “specified services” (such as lawyers and doctors) must have taxable income of less than $315,000 for a married couple (or half that for a single individual) to be fully eligible—with the benefit phasing down over the next $100,000."Games they will play" makes no mention of this or any other marginal rate. As is common in tax analysts they are great on disincentive margins to game tax payments by reclassifying income, but not so good on these marginal incentives.

I would love to see a true marginal analysis of the tax proposal. What are its actual incentives and disincentives, when you put it all together, not the constant who-gets-what commentary.

"Games They Will Play" is good reading if you have half a mind to pick up your pitchfork and join the other peasants in rebellion. It's phrased as problems with the new tax code, but it gives you a great condensed sense of just how rotten the old tax code is.

Monday, December 18, 2017

Universities and taxes

The recent tax bill discussion revealed many ways that universities benefit from lots of obscure tax subsidies like everyone else in contemporary America, and that they're pretty good at lobbying to keep them. Two issues stood out to me as worth comment.

1) Taxing graduate school tuition waivers. This caused an uproar, even among economists and economics graduate students who should know better.

PhD students largely do not pay tuition, and most of them get modest stipends. The reason is pretty simple -- the supply curve of graduate students to research-oriented PhDs is pretty flat. People won't come to graduate school if they have to pay tuition, or taxes on fictitious tuition. There is an annual bidding war in stipends to get the promising students, supply and demand in action. So the idea that graduate students would end up paying a lot either in tuition or taxes violates simple economics.

Moreover, nobody stopped to ask, why do universities pretend to charge tuition, and then waive it?Just how hard would it be for universities to adapt to the tax by not charging tuition in the first place? Why is tuition like medical bills, with a phoney-baloney list price and then everyone gets a huge discount of one sort or another?

Carlos Carvalho and Richard Lowery figured out the answer to this question: Many graduate students, especially in the sciences, get funding from the federal government, and to a lesser extent from private sources. The university charges "tuition" to the grant. So "tuition" is just a way for universities to tax federal grants, and to transfer money that would otherwise flow to students, departments, and research instead to central budgets and general university operations.

1) Taxing graduate school tuition waivers. This caused an uproar, even among economists and economics graduate students who should know better.

PhD students largely do not pay tuition, and most of them get modest stipends. The reason is pretty simple -- the supply curve of graduate students to research-oriented PhDs is pretty flat. People won't come to graduate school if they have to pay tuition, or taxes on fictitious tuition. There is an annual bidding war in stipends to get the promising students, supply and demand in action. So the idea that graduate students would end up paying a lot either in tuition or taxes violates simple economics.

Moreover, nobody stopped to ask, why do universities pretend to charge tuition, and then waive it?Just how hard would it be for universities to adapt to the tax by not charging tuition in the first place? Why is tuition like medical bills, with a phoney-baloney list price and then everyone gets a huge discount of one sort or another?

Carlos Carvalho and Richard Lowery figured out the answer to this question: Many graduate students, especially in the sciences, get funding from the federal government, and to a lesser extent from private sources. The university charges "tuition" to the grant. So "tuition" is just a way for universities to tax federal grants, and to transfer money that would otherwise flow to students, departments, and research instead to central budgets and general university operations.

Friday, December 15, 2017

Hazlett on Spectrum

The public and media discussion of "net neutrality" seems to have degenerated to "we want stuff for free." In the end, it does cost something to deliver internet, and the bandwith is limited.

The (artfully named) "net neutrality" regulation was really a return to utility rate regulation, in which the regulators say who gets what, and how much they can charge. Just what a rosy success that was not, seems to have been forgotten.

In this context, it seems especially worth reporting on an event from last week. Tom Hazlett, former Chief Economist of the FCC, came to Hoover to discuss his new book "Political Spectrum," which covers the history of the US government regulation of radio (TV, and cell phone) waves, largely through the same FCC that was in charge of "net neutrality." (I haven't read the book, this is a summary of the seminar discussion.)

Contrary to conventional wisdom, the market for spectrum worked well until 1927, in just the way economists might expect. Property rights to spectrum emerged, evolved, and worked well.

Radio was, at first, considered only for point to point communication. It stayed that way until 1920, when the first broadcast occurred. Within 2 years there were 500 broadcasters.

Contrary to the common allegation of “etheric bedlam” the market was actually orderly through 1926. Under the 1912 radio statute, the Department of Commerce enforced first-come first-serve rules, basically homesteader rights to spectrum in a geographic area and time. Those emergent property rights were registered with Department of Commerce, and easily bought and sold. If a new station encroached on your frequency/geography, you could quickly sue and stop it.

Regulation emerged in much the way a public choice economist might predict. The regulators wanted much more discretion — they wanted to control who got to broadcast and what was said. The large commercial stations wanted to limit entry and competition. The National Association of Broadcasters quickly became a lobbying group and advocated “public interest, convenience, and necessity” to regulate. [Yes, in only 5 years an industry that nobody had ever heard of or thought of became an incumbent lobbying force for regulation to stop entry and competition.] Herbert Hoover, (sadly) the commerce secretary at the time stopped enforcing enforcing first-come first-serve rights in 1926. Now there was indeed chaos, the “breakdown in the law.” According to Hazlett, this was a strategic breakdown to get regulation going. That regulation was formalized in the 1927 radio act. The first sentence of the act preempted private rights to spectrum.

Now, rather than property rights, spectrum was allocated by a “mother may I” system. In 1932 FCC, took over authority of wires to.

Regulation was quickly captured to stop competition and innovation.

The (artfully named) "net neutrality" regulation was really a return to utility rate regulation, in which the regulators say who gets what, and how much they can charge. Just what a rosy success that was not, seems to have been forgotten.

In this context, it seems especially worth reporting on an event from last week. Tom Hazlett, former Chief Economist of the FCC, came to Hoover to discuss his new book "Political Spectrum," which covers the history of the US government regulation of radio (TV, and cell phone) waves, largely through the same FCC that was in charge of "net neutrality." (I haven't read the book, this is a summary of the seminar discussion.)

Contrary to conventional wisdom, the market for spectrum worked well until 1927, in just the way economists might expect. Property rights to spectrum emerged, evolved, and worked well.

Radio was, at first, considered only for point to point communication. It stayed that way until 1920, when the first broadcast occurred. Within 2 years there were 500 broadcasters.

Contrary to the common allegation of “etheric bedlam” the market was actually orderly through 1926. Under the 1912 radio statute, the Department of Commerce enforced first-come first-serve rules, basically homesteader rights to spectrum in a geographic area and time. Those emergent property rights were registered with Department of Commerce, and easily bought and sold. If a new station encroached on your frequency/geography, you could quickly sue and stop it.

Regulation emerged in much the way a public choice economist might predict. The regulators wanted much more discretion — they wanted to control who got to broadcast and what was said. The large commercial stations wanted to limit entry and competition. The National Association of Broadcasters quickly became a lobbying group and advocated “public interest, convenience, and necessity” to regulate. [Yes, in only 5 years an industry that nobody had ever heard of or thought of became an incumbent lobbying force for regulation to stop entry and competition.] Herbert Hoover, (sadly) the commerce secretary at the time stopped enforcing enforcing first-come first-serve rights in 1926. Now there was indeed chaos, the “breakdown in the law.” According to Hazlett, this was a strategic breakdown to get regulation going. That regulation was formalized in the 1927 radio act. The first sentence of the act preempted private rights to spectrum.

Now, rather than property rights, spectrum was allocated by a “mother may I” system. In 1932 FCC, took over authority of wires to.

Regulation was quickly captured to stop competition and innovation.

Thursday, December 14, 2017

Exceptionalism

Law and the Regulatory State is a little essay, my contribution to American Exceptionalism in a new Era, a volume of such essays by Hoover Fellows. It takes up where Rule of Law in the Regulatory State left off.

A few snippets:

A few snippets:

To be a conservative—or, as in my case, an empirical, Pax-Americana, rule-of-law, constitutionalist, conservative libertarian—is pretty much by definition to believe that America is “exceptional”—and that it is perpetually in danger of losing that precious characteristic.

So why is America exceptional, in the good sense? Here, I think, economics provides a crucial answer. The ideas that American exceptionalism propounds have led to the most dramatic improvement in widely shared well-being in human history.... Without this economic success, I doubt that anyone would call America exceptional.

Despite the promises of monarchs, autocrats, dictators, commissars, central planners, socialists, industrial policy makers, progressive nudgers, and assorted dirigistes, it is liberty and rule of law that has led to this enormous progress.

I locate the core source of America’s exceptional nature in our legal system—the nexus of constitutional government, artfully created with checks and balances, and of the rule of law that guides our affairs. And this is also where I locate the greatest danger at the moment.

The erosion of rule of law is all around us. I see it most clearly in the explosion of the administrative, regulatory state.This is the main theme:

the rules are so vague and complex that nobody knows what they really mean.. the “rules” really just mean discretion for the regulators to do what they want—often to coerce the behavior they want out of companies by the threat of an arbitrary adverse decision.

The basic rights that citizens are supposed to have in the face of the law are also vanishing in the regulatory state.

Retroactive decisions are common,..

I fear even more the political impact. ... The drive toward criminalizing regulatory witch hunts and going after the executives means one thing: those executives had better make sure their organizations stay in line.

The key attribute that makes America exceptional—and prosperous—is that candidates and their supporters can afford to lose elections. Grumble, sit back, regroup, and try again next time. They won’t lose their jobs or their businesses. They won’t suddenly encounter trouble getting permits and approvals. They won’t have alphabet soup agencies at their doors with investigations and fines... We are losing that attribute.

In many countries, people can’t afford to lose elections. Those in power do not give it up easily. Those out of power are reduced to violence. American exceptionalism does not mean that all the bad things that happen elsewhere in the world cannot happen here.Always be optimistic though:

The third article in exceptionalist faith, however, is optimism: that despite the ever-gathering clouds, America will once again face the challenge and reform. There is a reason that lovers of liberty tend to be Chicago Cubs fans.The other essays are great. Niall Ferguson basically thinks exceptionalism is over.

Wednesday, December 13, 2017

Asset Pricing Competition

John Campbell's text, "Financial Decisions and Markets" is out from Princeton University Press. With some mild chagrin, I must say it's a splendid book. (Chagrin, of course, because it's an obvious major competitor to my own effort in Asset Pricing.)

It is spare, concise, and clearly written. How can I say that of a 450 page book, with wide text and tiny margins? Well, it's the concise version of the Encyclopedia Britannica, breathtakingly comprehensive and up to date in its coverage of important research topics.

The first part is a whirlwind tour of asset pricing theory. Here, John adopts the traditional organization -- expected utility, static portfolio choice, static CAPM and APT as equilibrium relations where supply meets demand, and finally we meet the discount factor and consumption-based pricing. I chose to go the other way around, and start with the basic asset pricing equation \(p_t u'(c_t) = E_t [\beta u'(c_{t+1}) x_{t+1} ]\), following Bob Lucas' insight that asset pricing is the same as in an endowment economy, and filling out the CAPM and APT and so forth as special cases. I never even got to portfolio theory -- it's in a draft chapter for the long-delayed next version. I still think that's the right organization, but most people don't want to teach it that way. John's more conventional organization, combined with clarity and concision, may be more what you want.

Even here, John's empirical taste and contributions rings through Any textbook is in many ways a summary of its authors' research journey, and John's journey has gone far and wide. You see a preview of the style on the 6th page of chapter 2 (p. 28) where you meet approximations for log returns, and the growth-optimal portfolio on the next page. On calculating minimum-variance portfolios, on p. 37, you get graph of time-varying return correlations from Campbell Lettau Milkier and Xu (2001), a provocative fact usually ignored. After efficiently presenting the classic CAPM, we get (p. 51) an insightful application to Harvard's endowment, highlighting the difficulties of using these oft-repeated portfolio and pricing theories in practice.

Friday, December 8, 2017

The hard road of free markets

The fundamental reason so many markets are not free, and so dysfunctional, is that the voters of our democracy don't really want freedom. Freedom will come when we want it, when we insist on it, when the average voter sees a free market solution rather than endless controls as the answer to real world problems. The sad paradox of free markets is that free markets do not need people to understand them to work. But democracy does require voters to understand how things work.

In that vein today's internet browsing (both HT marginal revolution) brings good news and bad news.

Good news - one more piece of evidence that people from left and right are finally beginning to see the huge damage of zoning and construction restrictions, including inequality, income segregation, and perpetuation of economic status. That "progressives" now see this too is a most heartening development.

In that vein today's internet browsing (both HT marginal revolution) brings good news and bad news.

Good news - one more piece of evidence that people from left and right are finally beginning to see the huge damage of zoning and construction restrictions, including inequality, income segregation, and perpetuation of economic status. That "progressives" now see this too is a most heartening development.

Thursday, November 30, 2017

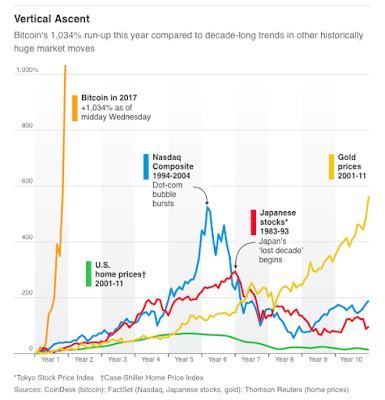

Bitcoin and Bubbles

|

| Source: Wall Street Journal |

So, what's up with Bitcoin? Is it a "bubble?'' A mania of irrational crowds?

It strikes me as a fairly pure instance of a regularly occurring phenomenon in financial markets, one that encompasses some "excess valuations" in stock markets, gold and commodities, and money itself.

Let's put the pieces together. The first equation of asset pricing is that price = expected present value of dividends. Bitcoin has no cash dividends, and never will. So right off the bat we have a problem -- and a case that suggests how other assets might have value above and beyond their cash dividends.

Well, if the price is greater than zero, either people see some "dividend," some value in holding the asset, beyond its cash payments; equivalently they are willing to hold the asset despite a lower expected return going forward, or they think the price will keep going up forever, so that price appreciation alone provides a competitive return. The first two are called "convenience yield," the latter is a "rational bubble."

"Rational bubbles" are intriguing, but I think fundamentally flawed. If a price goes up forever, eventually the value of bitcoin must exceed all of US wealth, then all of world wealth, then all of interplanetary wealth, then all of the atoms in the universe. The "greater fool" or Ponzi scheme theory must break down at some point, or rely on an irrational belief in the next fool. The rational bubbles theory also does not account for the association of price surges with high volatility and high trading volume.

So, let's think about "convenience yield." Why might someone be willing to hold bitcoins even though their price is above "fundamental value" -- equivalently even though their expected return over a decently long horizon is lower than that of stocks and bonds? Even though we know pretty much for sure that within our lifetimes bitcoin will become worthless? (If you're not sure on that, more later)

Wednesday, November 29, 2017

Eight Heresies of Monetary Policy

Eight Heresies of Monetary Policy

This is a talk I gave for Hoover, which blog readers might enjoy. Yes, it puts together many pieces said before. This

post has graphs and uses mathjax for equations, so if it isn't showing come back to the original. Also here is a pdf version which may be more readable.

Background

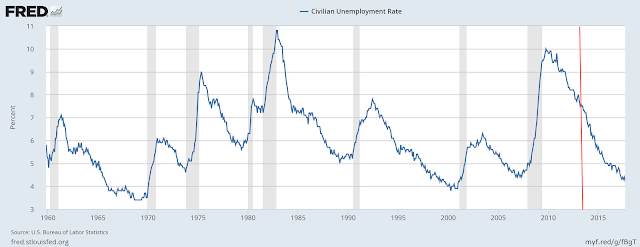

As background, the first graph reminds you of the current situation and recent history of monetary policy.

The federal funds rate is the interest rate that the Federal Reserve controls. The funds rate rises in economic expansions, and goes down in recessions. You can see this pattern in the last two recessions. Since about 2012, though, when following history you might have expected the funds rate to rise again, it has stayed essentially at zero. Very recently it has started to rise, but very slowly, nothing like 2005.

The black line is reserves. These are accounts that banks have at the Fed. Crucially, these bank accounts now pay interest. Starting in 2008, reserves grew dramatically from about $20 billion to $2,500 billion. The three cliffs are the three quantitative easing' episodes. Here, the Fed bought bonds and mortgage backed securities, giving banks reserves in exchange.

Inflation initially followed the same pattern as in the last recession. It fell in the recession, and bounced back again in 2012.Inflation has been slowly decreasing since. 10 year government bonds have been quietly trending down, with a bit of an extra dip during the recession.

The next graph plots US unemployment and GDP growth.

You can see we had a deeper recession, but then unemployment recovered about as it always does, or if anything a little faster. You can see the big drop in GDP during the recession. Subsequent growth has been overall too low, in my view, but it has been very steady. If anything, both growth and inflation are steadier in the era of zero interest rates than they were when the Fed was actively moving interest rates around.

These central facts motivate my heresies: Inflation, long term interest rates, growth and unemployment seem to be behaving in utterly normal ways. Yet the monetary environment of near-zero short term rates and huge QE is nothing but normal. How do we make sense of these facts?

Heresy 1: Interest rates

- Conventional Wisdom: Years of near zero interest rates and massive quantitative easing imply loose monetary policy, "extraordinary accommodation,'' and "stimulus.''

- Heresy 1: Interest rates are roughly neutral. If anything, the Fed has been (unwittingly) holding rates up since 2008.

Wednesday, November 15, 2017

Journal graphics in a bygone era

To illustrate MV = PY. (It was MV=PT then.) In Irving Fisher, "The Equation of Exchange 1896-1910," The American Economic Review Vol. 1, No. 2 (June, 1911), pp. 296-305, via JSTOR.

Tuesday, November 14, 2017

Mind the Gap

Mind the Gap is an extraordinary blog post on land use regulations. (HT the dependably excellent Marginal Revolution.) It is great for its detail, but most of all for its fresh voice. Sure, send one of my free-market economist friends in to examine the pathologies of any city, and we start almost reflexively on land use regulations. But the author is clearly from a different background -- the sort of person who "was in Hamtramck, Michigan a couple of years ago to participate in a seminar about reactivating neighborhoods." Lessons discovered the hard way, from different backgrounds, are often the freshest.

The big point of the blog post is how land use regulations force a steppingstone pattern of urban decay. It's hopelessly expensive to convert any building "up" the economic foodchain of uses, so bit by bit buildings get used for less and less productive uses, that don't attract the attention of regulators, until they become vacant lots, or until a large commercial developer can come in, demand tax subsidies, and rebuild the whole neighborhood.

The post starts with the story of a family that

(The post is full of great photographs like this one.) So instead,

The big point of the blog post is how land use regulations force a steppingstone pattern of urban decay. It's hopelessly expensive to convert any building "up" the economic foodchain of uses, so bit by bit buildings get used for less and less productive uses, that don't attract the attention of regulators, until they become vacant lots, or until a large commercial developer can come in, demand tax subsidies, and rebuild the whole neighborhood.

The post starts with the story of a family that

bought an old fire station a few years ago with the intention of turning it in to a Portuguese bakery and brew pub.Alas,

Mandatory parking requirements, sidewalks, curb cuts, fire lanes, on site stormwater management, handicapped accessibility, draught tolerant native plantings… It’s a very long list that totaled $340,000 worth of work. They only paid $245,000 for the entire property. And that’s before they even started bringing the building itself up to code for their intended use. Guess what? They decided not to open the bakery or brewery. Big surprise.

(The post is full of great photographs like this one.) So instead,

Monday, November 13, 2017

Two on energy subsidies

The WSJ has two good and related opeds on energy and transport subsidies recently, Randall O'Toole on Last Stop on the Light-Rail Gravy Train and Lee Ohanian and Ted Temzelides write on energy and transport subsidies

O'Toole:

I love trains. But we have to admit practicalities. One transportation economist summed all there is to know about transit with "Bus Good. Train Bad." (With a few exceptions, such as Manhattan.) And light rail, worse. Trains are expensive, and once built, immobile. If people want to go somewhere else, tough. Rolling stock lasts around 50 years, meaning they bake in technical obsolescence. Trains carry far fewer people per lane-mile than busses. And a fleet of self-driving Ubers linked by computer will be able to use bus lanes.

Actually, even buses are more and more questionable. As I wait for the interminable lights on El Camino to cross to Stanford (on bicycle), I have taken to counting passengers on the well-subsidized bus line. The modal number is zero.

As Randy has pointed out elsewhere, the main beneficiaries of light rail are suburban largely white commuters with a nostalgia thing for trains. The main people paying for it are inner city minorities who don't get bus service anymore.

Lee and Ted consider the transition from horse to auto and truck,

(Actually, the government did subsidize railroads a good deal, and perhaps by doing so did stall the development of the truck.)

More than horse manure, I love the image of an alternate reality steampunk America...At left a cool steampunk RV. (Image source)

Which brings us back, I'm afraid to the main force behind rail subsidies, which Randall has pointed out before: Nostalgia. Nostalgia for what seems like a simpler age. I understand that too. I love trains. But that doesn't make them practical, especially at billions of dollars per mile.

If we're doing nostalgia, how about doing it full time -- high speed stagecoach lines? Bring back the horse! It's all renewable!'

O'Toole:

Last month, Nashville Mayor Megan Berry announced a $5.2 billion proposal that involves building 26 miles of light rail and digging an expensive tunnel under the city’s downtown. Voters will be asked in May to approve a half-cent sales tax increase plus additions to hotel, car rental and business excise taxes to pay for the project.Just in time for self-driving Ubers to arrive.

I love trains. But we have to admit practicalities. One transportation economist summed all there is to know about transit with "Bus Good. Train Bad." (With a few exceptions, such as Manhattan.) And light rail, worse. Trains are expensive, and once built, immobile. If people want to go somewhere else, tough. Rolling stock lasts around 50 years, meaning they bake in technical obsolescence. Trains carry far fewer people per lane-mile than busses. And a fleet of self-driving Ubers linked by computer will be able to use bus lanes.

Actually, even buses are more and more questionable. As I wait for the interminable lights on El Camino to cross to Stanford (on bicycle), I have taken to counting passengers on the well-subsidized bus line. The modal number is zero.

As Randy has pointed out elsewhere, the main beneficiaries of light rail are suburban largely white commuters with a nostalgia thing for trains. The main people paying for it are inner city minorities who don't get bus service anymore.

To pay for new light-rail lines that opened in 2012 and 2016, Los Angeles cut bus service. The city lost nearly four bus riders for every additional rail rider.Congestion got you down? Real time tolling, adjusted minute by minute, will either cure traffic congestion forever, or will bail out indebted local governments with massive revenues, or both. Or, let people live somewhere near where they work!

Lee and Ted consider the transition from horse to auto and truck,

‘In 50 years, every street in London will be buried under 9 feet of manure.” With this 1894 prediction, the London Times warned that the era’s primary source of transportation energy—the horse—would soon create an environmental crisis. ...

The enormous demand for a cleaner and more efficient source of energy led to remarkable innovations in the internal combustion engine. By 1920 horses in cities had been almost entirely replaced by affordable autos and trucks...And to be honest, horse manure replaced by auto exhaust -- but as bad as auto exhaust is, it's a lot better than horse manure.

Suppose governments in the 1890s, desperate to replace the horse, had jumped on the first available alternative, the steam engine. Heavy subsidies would have produced more steam engines and more research on steam technology. This would only have waylaid the development of the far superior internal combustion engine.

|

| Source: Obtainium works. |

More than horse manure, I love the image of an alternate reality steampunk America...At left a cool steampunk RV. (Image source)

Which brings us back, I'm afraid to the main force behind rail subsidies, which Randall has pointed out before: Nostalgia. Nostalgia for what seems like a simpler age. I understand that too. I love trains. But that doesn't make them practical, especially at billions of dollars per mile.

If we're doing nostalgia, how about doing it full time -- high speed stagecoach lines? Bring back the horse! It's all renewable!'

Thursday, November 9, 2017

The real questions the Fed should ask itself

The real questions the Fed should ask itself. This is a cleaned up and edited version of a previous blog post, commenting among other things on Janet Yellen's Jackson Hole speech in favor of most of Dodd Frank, that appeared in the Chicago Booth Review. When you think of the Fed, think more of the giant regulator than about where interest rates go.

Thursday, November 2, 2017

Yellen Retrospective

The newspapers report today that President Trump has decided to nominate Jerome Powell to replace Janet Yellen as Fed Chair.

The Federal Reserve's mandate is to "promote maximum employment, stable prices, and moderate long- term interest rates." Ms. Yellen can look back with pride on these outcomes during her term:

All three variables are doing better than they have in half a century. Many people complain about many things at the Fed, including me, but relative to the stated mandate, she has every right to put these charts on the wall of her new office.

One could complain that Ms. Yellen didn't face any particular challenges. As presidents are tested in wartime, so Fed chairs are tested by events. Ms. Yellen didn't face a recession or financial crisis. In this quiet late summer of the business cycle, her job was largely to do nothing, and resist calls from people who wanted her to take big steps. The Fed's major tool is the federal funds rate, has barely moved.

True, but she did not screw up either. So much of monetary history consists of unforced errors, that not making one is an accomplishment. The late summer of business cycles has historically been a time when central bankers over or under react. And there has been no lack of loud voices calling for drastic action one way or another. In particular, the siren song of "macro prudential policy" that the Federal Reserve should manipulate stock and housing prices has been strong. Her predecessor, Ben Bernanke, will be much more written about for the Fed's management of the 2008 crisis and recession, as well for its failure to see it coming in 2007. Not screwing up doesn't earn you as big a place in history, but perhaps it should.

No matter how one feels about monetary policy, and the more important (in my view) question of Fed financial regulation, President Trump is breaking with tradition by not reappointing her. The tradition that if the Fed chair has done a reasonable job, he or she is reappointed is a good one for maintaining the independence of the Fed. Let us hope that it is not gone for good.

Good luck to Ms. Yellen in her next endeavor. And to Mr. Powell in this one.

The Federal Reserve's mandate is to "promote maximum employment, stable prices, and moderate long- term interest rates." Ms. Yellen can look back with pride on these outcomes during her term:

One could complain that Ms. Yellen didn't face any particular challenges. As presidents are tested in wartime, so Fed chairs are tested by events. Ms. Yellen didn't face a recession or financial crisis. In this quiet late summer of the business cycle, her job was largely to do nothing, and resist calls from people who wanted her to take big steps. The Fed's major tool is the federal funds rate, has barely moved.

True, but she did not screw up either. So much of monetary history consists of unforced errors, that not making one is an accomplishment. The late summer of business cycles has historically been a time when central bankers over or under react. And there has been no lack of loud voices calling for drastic action one way or another. In particular, the siren song of "macro prudential policy" that the Federal Reserve should manipulate stock and housing prices has been strong. Her predecessor, Ben Bernanke, will be much more written about for the Fed's management of the 2008 crisis and recession, as well for its failure to see it coming in 2007. Not screwing up doesn't earn you as big a place in history, but perhaps it should.

No matter how one feels about monetary policy, and the more important (in my view) question of Fed financial regulation, President Trump is breaking with tradition by not reappointing her. The tradition that if the Fed chair has done a reasonable job, he or she is reappointed is a good one for maintaining the independence of the Fed. Let us hope that it is not gone for good.

Good luck to Ms. Yellen in her next endeavor. And to Mr. Powell in this one.

Wednesday, November 1, 2017

Tax Graph

The tax discussion is moving to personal income taxes, and the world is waiting to hear the actual Republican proposal, due tomorrow (Thursday).

With apologies to blog readers who know all this in their sleep, I thought I might explain just why (some) economists keep chanting "broaden the base, lower marginal rates," or why I keep saying that taxes don't matter, tax rates matter to economic growth. This is grumpy economist, Saturday morning cartoon edition. Perhaps a colorful graph will help as you try to explain taxes to relatives this Thanksgiving.

Start with the blue line. Suppose you work 40 hours a week, and make $100,000. Suppose the government wants half of it. One way to get that is with a flat tax -- for every dollar you earn, send 50 cents to the government. The government gets $50,000.

Now consider the red line. This line can represent a progressive tax: Exempt the first $50,000 of income, so people who make less have to pay a smaller share of their income in taxes, and charge a 100% tax rate on the rest. Equivalently, this line represents $50,000 of tax shelters and deductions -- employer-provided health care, charitable contributions to a foundation that employs your relatives and flies you around on private jets, a deduction for home mortgage interest, credits for the solar cells on your roof, and so on.

At first glance, this tax system raises the same amount of money. (That's "static scoring.")

You can see the hole in the argument. If we tax the marginal dollar after $50,000 at 100%, you won't bother working the second 20 hours, and the government will get no revenue. More deeply, slowly, and insidiously, in my view, people choose easy college majors that lead to $50,000 jobs, not harder ones that lead to $100,000 jobs, or they don't start businesses.

Friday, October 27, 2017

Economists and taxes

My last post on taxes continued the question, who bears the burden of the corporate tax? Will a reduction in corporate taxes benefit stockholders or workers? It was a fun technical discussion.

But the whole time I want to scream: That is the wrong question! And the public economists job should be to scream from the rafters, that is the wrong question! By just accepting the question, we are doomed to bad answers.

The public, and politicians, analyze taxes entirely through the lens of who gains and who loses. Income redistribution, yes, but also redistribution from renters to homeowners, married to unmarried, young to old, city dwellers to farmers, Texans to Californians, and so on. The political and popular discussion is about taxES, and who pays what.

Economists serve best when they offer thoughts outside the standard left-right partisan divide. Our first function should be always to remind people that marginal tax rates matter to the economy not taxes.

Our second insight is always to analyze things comprehensively. The Federal income tax is not what counts, the entire wedge between work and consumption matters. Whether the corporate tax is progressive or not does not matter, whether the overall tax code is progressive (plus the overall spending code, and forced cross-subsidy code!) matters. Don't tax wine over beer to redistribute; tax goods evenly and achieve progressivity through a progressive income (or better, consumption) tax, or spend money on programs to help people whose distress is correlated (imperfectly) with beer drinking.

Economists may feel their moral sentiments about redistribution are really important. But we have little professional reason to argue our feelings are better than anyone else's. What we can argue is, if you'r going to do more or less redistribution, do it efficiently and comprehensively.

In this context, the current tax reform proposal, and its instant dismissal from self-identified Democratic economists, echoing political rhetoric, is a deep disappointment.

The economists' tax reform starts with a detailed breakdown by income. (I'm caving to political reality that our nation is obsessed with income, not more meaningful measures of economic advantage and disadvantage.) Then, we create a tax reform in which each group pays the same amount (ideally, bears the same burden), but trades lower marginal rates for fewer deductions, exemptions, and for the reduction or elimination of taxes that either highly distort economic activity or lead to lots of inefficient avoidance (corporate, rates of return, estate).

In short, we aim for a revenue-neutral, redistribution-neutral, reform. We recognize that eventually tax rates must be high enough to cover spending. There isn't a big need to argue over Laffer effects. Even if scored as statically revenue neutral, when the economy booms, revenue flows in, and we have paid off the debt we can start lowering rates. We recognize that if the structure if the tax reform is fixed, we can later continue to argue over the right amount of redistribution.

1986 came close. It wasn't perfect. But at least the rhetoric was this, and politicians explained this goal to the public. You will pay the same taxes, but at lower rates for fewer deductions, and the economy will grow. And lo, it did.

For thirty-one years, we have waited to finish the job. As the tax code grew more complex, with higher statutory rates and more deductions, we waited to redo the job. Reform proposal came and went, with at least a nod to this amount of economic sense.

But no more. Now tax policy is all redistribution all the time. Democratic politicians have decided that their mantra is "tax cuts for the rich." Well, a slogan is a slogan. More sadly, self-identified democratic economists echo this mantra, and little other. Anytime you're arguing one side's talking point or another, you're doing little to illuminate a discussion.

Each provision is examined in isolation for its redistributive impact. It's profoundly hypocritical of course. Tax deductions are indeed a "tax cut for the rich" since people in the 40% marginal bracket who itemize get a lot more than Joe and Jane down in the lower brackets. But you hear either silence, or pretzel logic defense, such as the New York Times defense of the profoundly regressive deduction for state and local taxes.

I was disappointed at both the rhetoric and the small progress of the administration's proposal's to date. Yes, cutting the corporate rate is a good idea. But they don't even try to argue for marginal rate reductions or incentives. The buzzword is to give "tax cuts to help the middle class," which the left can then argue is a "lie" or not. Once you fall for redistributionist rhetoric, once you say that tax policy is all about giving the right people more and the wrong people less money, I think the hope for a tax reform that actually gets the economy going is dim.

The holy trinity was off the table from the start -- home mortgage interest deduction, charitable deduction, and employer-provided health deduction. The fourth horseman of the apocalypse, the deduction for state and local taxes, is in danger. (Sorry for mixing metaphors!) This is like a wayward husband saying, "sure, I'll clean up my act. However, the drinking, gambling, and smoking are off the table." The corporate tax reduction does not seem to be coming with a serious cleanup of the thousands of deductions and extenders, each catnip to the lobbyists who keep them in place.

The political challenge for a reform is to say to each group, "you're going to give up your deduction, yes even interest on future home mortgages. But, your rates will go down so much that you will end up paying no more overall, and as the economy grows you will pay less. I want your help holding the fort against those who will demand their deductions and subsidies." That's a deal that pretty much held together in 1986. But if we go into the negotiation saying "oh, and by the way the big three are getting theirs unscathed," and "therefore really big rate reductions are off the table," then the hope of putting that coalition together is gone. It's a free for all, call your congressperson and make sure you keep yours.

But the whole time I want to scream: That is the wrong question! And the public economists job should be to scream from the rafters, that is the wrong question! By just accepting the question, we are doomed to bad answers.

The public, and politicians, analyze taxes entirely through the lens of who gains and who loses. Income redistribution, yes, but also redistribution from renters to homeowners, married to unmarried, young to old, city dwellers to farmers, Texans to Californians, and so on. The political and popular discussion is about taxES, and who pays what.

Economists serve best when they offer thoughts outside the standard left-right partisan divide. Our first function should be always to remind people that marginal tax rates matter to the economy not taxes.

Our second insight is always to analyze things comprehensively. The Federal income tax is not what counts, the entire wedge between work and consumption matters. Whether the corporate tax is progressive or not does not matter, whether the overall tax code is progressive (plus the overall spending code, and forced cross-subsidy code!) matters. Don't tax wine over beer to redistribute; tax goods evenly and achieve progressivity through a progressive income (or better, consumption) tax, or spend money on programs to help people whose distress is correlated (imperfectly) with beer drinking.

Economists may feel their moral sentiments about redistribution are really important. But we have little professional reason to argue our feelings are better than anyone else's. What we can argue is, if you'r going to do more or less redistribution, do it efficiently and comprehensively.

In this context, the current tax reform proposal, and its instant dismissal from self-identified Democratic economists, echoing political rhetoric, is a deep disappointment.

The economists' tax reform starts with a detailed breakdown by income. (I'm caving to political reality that our nation is obsessed with income, not more meaningful measures of economic advantage and disadvantage.) Then, we create a tax reform in which each group pays the same amount (ideally, bears the same burden), but trades lower marginal rates for fewer deductions, exemptions, and for the reduction or elimination of taxes that either highly distort economic activity or lead to lots of inefficient avoidance (corporate, rates of return, estate).

In short, we aim for a revenue-neutral, redistribution-neutral, reform. We recognize that eventually tax rates must be high enough to cover spending. There isn't a big need to argue over Laffer effects. Even if scored as statically revenue neutral, when the economy booms, revenue flows in, and we have paid off the debt we can start lowering rates. We recognize that if the structure if the tax reform is fixed, we can later continue to argue over the right amount of redistribution.

1986 came close. It wasn't perfect. But at least the rhetoric was this, and politicians explained this goal to the public. You will pay the same taxes, but at lower rates for fewer deductions, and the economy will grow. And lo, it did.

For thirty-one years, we have waited to finish the job. As the tax code grew more complex, with higher statutory rates and more deductions, we waited to redo the job. Reform proposal came and went, with at least a nod to this amount of economic sense.

But no more. Now tax policy is all redistribution all the time. Democratic politicians have decided that their mantra is "tax cuts for the rich." Well, a slogan is a slogan. More sadly, self-identified democratic economists echo this mantra, and little other. Anytime you're arguing one side's talking point or another, you're doing little to illuminate a discussion.

Each provision is examined in isolation for its redistributive impact. It's profoundly hypocritical of course. Tax deductions are indeed a "tax cut for the rich" since people in the 40% marginal bracket who itemize get a lot more than Joe and Jane down in the lower brackets. But you hear either silence, or pretzel logic defense, such as the New York Times defense of the profoundly regressive deduction for state and local taxes.

I was disappointed at both the rhetoric and the small progress of the administration's proposal's to date. Yes, cutting the corporate rate is a good idea. But they don't even try to argue for marginal rate reductions or incentives. The buzzword is to give "tax cuts to help the middle class," which the left can then argue is a "lie" or not. Once you fall for redistributionist rhetoric, once you say that tax policy is all about giving the right people more and the wrong people less money, I think the hope for a tax reform that actually gets the economy going is dim.

The holy trinity was off the table from the start -- home mortgage interest deduction, charitable deduction, and employer-provided health deduction. The fourth horseman of the apocalypse, the deduction for state and local taxes, is in danger. (Sorry for mixing metaphors!) This is like a wayward husband saying, "sure, I'll clean up my act. However, the drinking, gambling, and smoking are off the table." The corporate tax reduction does not seem to be coming with a serious cleanup of the thousands of deductions and extenders, each catnip to the lobbyists who keep them in place.

The political challenge for a reform is to say to each group, "you're going to give up your deduction, yes even interest on future home mortgages. But, your rates will go down so much that you will end up paying no more overall, and as the economy grows you will pay less. I want your help holding the fort against those who will demand their deductions and subsidies." That's a deal that pretty much held together in 1986. But if we go into the negotiation saying "oh, and by the way the big three are getting theirs unscathed," and "therefore really big rate reductions are off the table," then the hope of putting that coalition together is gone. It's a free for all, call your congressperson and make sure you keep yours.

The bottom line: I support the current tax proposal, as incomplete and flawed as it is. It is a step in the right direction. We get the corporate tax rates down to those common in that low-tax free-market nirvana, Europe. It is not, however, 1986 on its own.

I do not support the rhetoric. "Tax cuts" do not work absent spending cuts. Cuts in distorting marginal tax rates matter. The people in charge must surely understand this, so the choice to market it as "tax cuts for the middle class" represents, I think, an unwise rhetorical choice. The American people are smart enough to understand this, and playing redistribution, bidding for support with handouts, is not a winning game.

Moreover, the sense I have from talking to people, less enshrined in economic theory, is that massive tax complexity and uncertainty are larger drags on growth than a stable simple but high tax rate would be. I see "simplification" in the rhetoric, but no substantial simplification in the body of the proposal. It leaves most of the "finish 1986" job undone, and unless magic happens on entitlement reform, this tax bill will be undone soon as the deficit widens. If it is all we get, and if it is passed as Obamacare was passed, with no votes from the other party, it will not give the sense of permanence necessary to induce a lot of investment and growth.

It needs to be a first step, not this generation's tax reform for the next 31 years. I understand the politics. Republican leadership needs to do something. If Democrats will unite in "resistance" to a bill celebrating mom and apple pie, they need to do something on their own. If they do something, and look like winners, they can get support to do more. But it must be that first step. And even so, I would have hoped for some more courage in the first step. Enshrining the triplet of deductions without a fight, not even mentioning marginal rates, makes it ever harder to remove them in a second step.

And I wish I were hearing a lot of this, and not just echoing the political line "tax cuts for the rich," from top economists more critical of the proposals.

I do not support the rhetoric. "Tax cuts" do not work absent spending cuts. Cuts in distorting marginal tax rates matter. The people in charge must surely understand this, so the choice to market it as "tax cuts for the middle class" represents, I think, an unwise rhetorical choice. The American people are smart enough to understand this, and playing redistribution, bidding for support with handouts, is not a winning game.

Moreover, the sense I have from talking to people, less enshrined in economic theory, is that massive tax complexity and uncertainty are larger drags on growth than a stable simple but high tax rate would be. I see "simplification" in the rhetoric, but no substantial simplification in the body of the proposal. It leaves most of the "finish 1986" job undone, and unless magic happens on entitlement reform, this tax bill will be undone soon as the deficit widens. If it is all we get, and if it is passed as Obamacare was passed, with no votes from the other party, it will not give the sense of permanence necessary to induce a lot of investment and growth.

It needs to be a first step, not this generation's tax reform for the next 31 years. I understand the politics. Republican leadership needs to do something. If Democrats will unite in "resistance" to a bill celebrating mom and apple pie, they need to do something on their own. If they do something, and look like winners, they can get support to do more. But it must be that first step. And even so, I would have hoped for some more courage in the first step. Enshrining the triplet of deductions without a fight, not even mentioning marginal rates, makes it ever harder to remove them in a second step.

And I wish I were hearing a lot of this, and not just echoing the political line "tax cuts for the rich," from top economists more critical of the proposals.

Corporate tax burden again

This post continues the question, who bears the burden of the corporate tax? The next post will have broader thoughts on the tax plan and economists' reaction to it.

I'm responding in many ways to Larry Summers, who weighed in on the corporate taxes issue in a Washington Post oped. He eloquently and concisely makes most of the arguments floating around now against the corporate tax cut, so I don't have to wade through the venom in Krugman posts to find nuggets of economic sense that one discuss on objective grounds.

This is a long post, so let me summarize the conclusions

1) Even if stockholders do bear the burden of the corporate tax, that is entirely the stockholders who are there when the tax is announced. Current stockholders bear little or no burden.

2) The novel "monopoly" argument is seriously deficient.

3) Even if stockholders bear the burden of the corporate tax, the corporate tax is an insanely inefficient way to make a more progressive tax code.

So who does bear the burden of the corporate tax?

I think every economist in this debate admits, if some reluctantly, that "corporations" pay no taxes. As an accounting matter, every cent corporations pay comes from higher prices, lower wages, or lower payments to shareholders. The only question is which one. And indirect general equilibrium effects are central. The question is not just, how do corporations respond immediately, but how do wages, prices, and capital in the whole economy adjust. "Make corporations pay their fair share" is just nonsense.

I'm responding in many ways to Larry Summers, who weighed in on the corporate taxes issue in a Washington Post oped. He eloquently and concisely makes most of the arguments floating around now against the corporate tax cut, so I don't have to wade through the venom in Krugman posts to find nuggets of economic sense that one discuss on objective grounds.

This is a long post, so let me summarize the conclusions

1) Even if stockholders do bear the burden of the corporate tax, that is entirely the stockholders who are there when the tax is announced. Current stockholders bear little or no burden.

2) The novel "monopoly" argument is seriously deficient.

3) Even if stockholders bear the burden of the corporate tax, the corporate tax is an insanely inefficient way to make a more progressive tax code.

So who does bear the burden of the corporate tax?

I think every economist in this debate admits, if some reluctantly, that "corporations" pay no taxes. As an accounting matter, every cent corporations pay comes from higher prices, lower wages, or lower payments to shareholders. The only question is which one. And indirect general equilibrium effects are central. The question is not just, how do corporations respond immediately, but how do wages, prices, and capital in the whole economy adjust. "Make corporations pay their fair share" is just nonsense.

Tuesday, October 24, 2017

Hall graphs

Bob Hall gave a lovely talk on wages, and how a reduction in the cost of capital from tax or regulatory reform might raise capital, and by doing so raise labor productivity and hence wages. The graphs speak for themselves.

Saturday, October 21, 2017

Greg's algebra

How much do workers gain from a capital tax cut? This question has

reverberated in oped pages and blogosphere, with the usual

vitriol

at anyone

who might even speculate that a dollar in tax cuts could raise wages by more

than a dollar. (I vaguely recall more blogosphere discussion which I now can't find,

I welcome links from commenters. Greg was too polite to link to it.)

Greg Mankiw posted a really lovely little example of how this is, in fact, a rather natural result.

However, Greg posted it as a little puzzle, and the average reader may not have taken pen and paper out to solve the puzzle. (I will admit I had to take out pen and paper too.) So, here is the answer to Greg's puzzle, with a little of the background fleshed out.

The production technology is \[Y=F(K,L)=f(k)L;k\equiv K/L\] where the second equality defines \(f(k)\). For example \(K^{\alpha}L^{1-\alpha}=(K/L)^{\alpha}L\) is of this form. Firms maximize \[ \max\ (1-\tau)\left[ F(K,L)-wL \right] -rK \] \[ \max\ (1-\tau)\left[ f\left( \frac{K}{L}\right) L-wL \right] -rK \]